What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

30 June 2022 SMSF Checklist

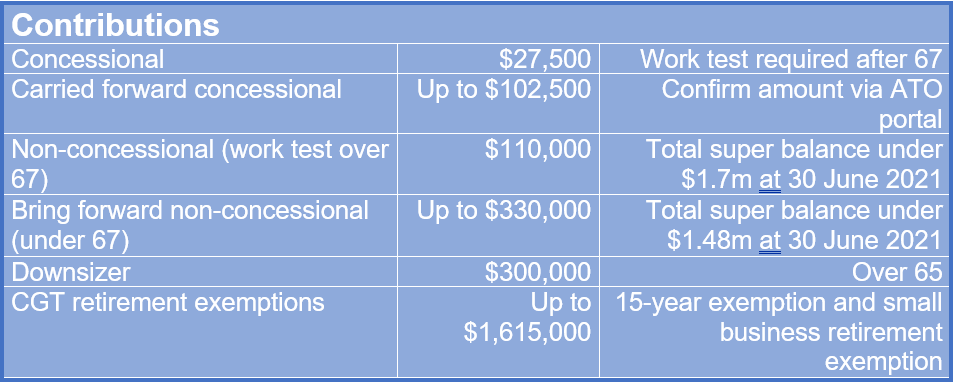

| The end of the 2022 financial year is fast approaching and we would like to take an opportunity and provide all our clients SMSF year-end housekeeping checklist. 1. For SMSF Contributions, you are claiming a deduction for: Ensure notice of intent to claim tax deduction forms have been submitted and validated by the SMSF trustee before claiming a tax deduction. Just a reminder that here are the following contribution caps that apply in 2022: |

|

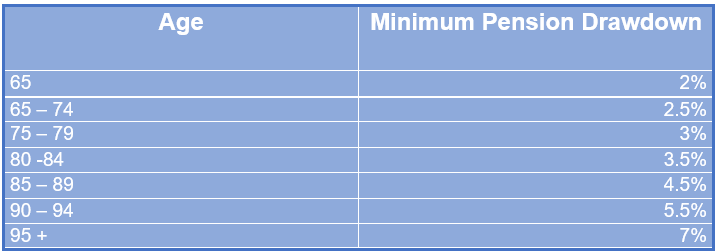

2. For SMSFs paying the pension: Ensure that the minimum pension is taken prior 30th of June 2022. Just a reminder that the minimum pension for 2021/2022 is the following: |

|

| Please don’t hesitate to contact me if you need a reminder of how much minimum pension you have to withdraw before 30 June 2022. 3. For SMSFs using contribution reserve strategy: Ensure reserving strategies have been documented. 4. For SMSFs with in-house assets (example, SMSF borrowings): Any ongoing in-house asset rectification plans should be actioned before 30 June 2022. 5. For SMSFs with property: Ensure you have a current market valuation from an independent source. 6. For SMSFs with cryptocurrency: Ensure you log in to your wallet/exchange on the 30th of June and do a screenshot of your SMSF crypto holdings. The screenshot should show the Name of the coin number of unitsDate (30 June 2022). 7. For SMSFs with unlisted unit trusts: SMSFs that are due to receive a distribution from an unlisted unit trust for this financial year must ensure the distribution is collected by 30 June to prevent it from being considered an in-house asset and damaging the status of the trust.8. For ALL SMSFs: Review Total Super Balance (TSB) in the lead-up to 30 June 2022. If your TSB is close to $1.7m and $500,000 as exceeding these may decrease your opportunity to contribute next Financial Year. |