What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

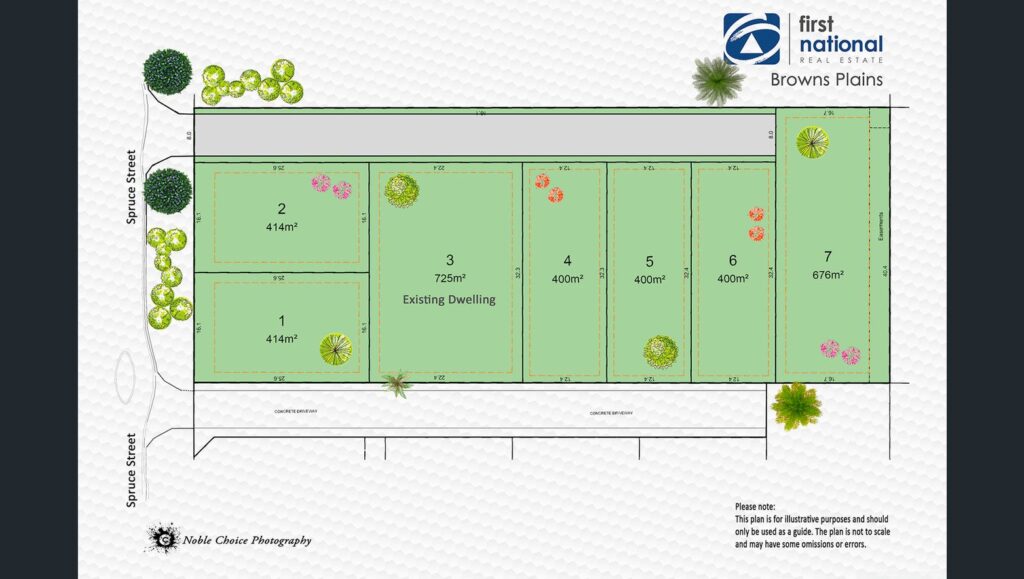

Property Developers Tax Planning

Property developers walk a fine line between profits on the sale of properties being considered by the ATO to be on a Revenue Account ( profits subject to income tax) or on a Capital Account (profits/gains subject to CGT, with a potential 50%).

Property developers walk a fine line between profits on the sale of properties being considered by the ATO to be on a Revenue Account ( profits subject to income tax) or on a Capital Account (profits/gains subject to CGT, with a potential 50%).

Careful planning for various tax treatments will impact the property development strategy, which could save tens of thousands of dollars in unnecessary taxes.

Projects that are considered on a Revenue Account, have the added complexity of potential being subject to GST or not?

It is important to understand and document your intentions at the start of a property development project so you can get advice to plan which tax treatment will be applicated to profits, either on Revenue or Capital Account, GST or Input Taxed (No GST) treatment on Sales.

The ATO will look to the objective intention or changes in intentions to assess the tax treatment. Intentions will indicate if the development is considered an enterprise, or an isolated one-off transaction that has the characteristic of a business deal or is seen as a mere realisation of a property.

![]() ATO – Determine if you are running a property development enterprise

ATO – Determine if you are running a property development enterprise

Related Insights

Tiny homes have excellent rental yields, income streaming and tax minimisation strategies. How do they compare to a Granny Flat?

What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

Easier for Victoricans to build Granny Flats from December 2023.

Secondary Dwelling From December 2023 the Victorian Government has passed planning changes to make it easier to build Granny Flats - or "small secondary dwellings", on existing homes. The Victorian Premier Jacinta Allan revealed that planning permits will no longer be...

Property Investors to ensure income and expenses are correct.

The ATO is particularly targeting property investors that are not using the help of a specialist property tax accountant like Umbrella Property Accountant, due to the high error rate being discovered from ATO Audits. The ATO Audits into self-preparers have uncovered...

2 main types of property developers

Passive

- Mere Realisation

- Flippers

Enterprise Property Developers

- GST Business Income

- Changing Intentions, capital to revenue account

Passive Property Developers – Buy, Develop and either (Hold or Sell)

Passive Property Developer uses two differing strategies.

These developers could be seen as accidental developers, looking to add value to hold or flip. The tax treatment can be subjective and vary dramatically according to the stated intentions.

These developers could be seen as accidental developers, looking to add value to hold or flip. The tax treatment can be subjective and vary dramatically according to the stated intentions.

The objective intentions as witnessed by the developer’s actions rather than any stated intentions will be judged by the ATO if any Tax Audit on how to treat profits on either Revenue or Capital Accounts.

To add to the complexity, any change of intention can also, signal a change in the tax treatment of the profits on any property sales.

Passive Developers Strategies

Higher Tax Compliance Risks on Profits!

Buy, Develop and Hold Strategy

(BDHS)

Mere Realisation

Profit – CGT

Buy, Develop and Sell Strategy

(BDSS)

Accidential Developers

Profits – CGT Provisions

Flippers

Profit – Ordinary Income

Mere realisation of an asset strategy

A “mere realisation of an asset” implies that the profits made are on a capital account, the gains assessed as statutory income under the capital gains tax provisions, and the opportunity to benefit from a 50% discount on any CGT. Otherwise, the activities conducted would be seen as an isolated business venture or enterprise and assessed as ordinary income at the owner’s full marginal tax rate.

A “mere realisation of an asset” implies that the profits made are on a capital account, the gains assessed as statutory income under the capital gains tax provisions, and the opportunity to benefit from a 50% discount on any CGT. Otherwise, the activities conducted would be seen as an isolated business venture or enterprise and assessed as ordinary income at the owner’s full marginal tax rate.

Factors to indicate a Mere Realisations of long-held assets prior to development.

- No profit motive at the time of purchase

- No history of property developments

- Minimal effort and risk were assumed to subdivide at a later stage.

- No construction of roads, buildings

Tax Treatment

- Property sales on a capital account generally will not be subject to GST, not a taxable supply. No GST, No ABN is required.

Factors to indicate a Mere Realisation of assets held long term after the development.

The main difference from the above example is that after the development will be a long-term hold for capital growth in the future.

- Long-term hold motive after the development

- Prior history of property development is not so important, however, may indicate a change from trading stock back to capital asset.

- Can have a high busines like effort and risk to subdived or construct is OK

Tax Treatment

- Assuming no change of intention, still no entitlement to an ABN, not able to claim or charge GST

- The sale of a new build under 5 years may be considered a change of intentions, so signal a GST liability and retrospective registration and ABN requirements.

- Property sales on a capital account generally will not be subject to GST, No GST, No ABN is required.

Accidential Developers

A property may be a PPOR in a inter-city location, and with the passing of time considered subdividing with or without retaining the ordinary PPOR on one of the lots for sale to realise greatest sale value.

A property may be a PPOR in a inter-city location, and with the passing of time considered subdividing with or without retaining the ordinary PPOR on one of the lots for sale to realise greatest sale value.

Factors to indicate a Accidential Developers

- similar to mere realisation strategy, however may go beyond what is required to then be seen as a isolated business enterprise.

Tax Treatment

- If enterprise (though isolation transaction)

- ABN & GST entitlement

- Profits as ordinary income

- If not enterprise

- No ABN or GST

- Profits on Captal Account.

Property Flippers

If you’re carrying on a business of renovating properties or ‘flipping’ properties:

- they are regarded as trading stock (even if you live in one for a short period)

- the costs associated with buying and renovating them form part of the cost of your trading stock until they’re sold

- you calculate your business’s annual profit or loss in the same way as any business with trading stock.

- you’re entitled to an Australian business number (ABN)

- you may be required to register for GST if the renovations are substantial.

CGT doesn’t apply to assets held as trading stock, and CGT concessions (such as the CGT discount, small business concessions and main residence exemption) don’t apply to any income from the sale of the properties.

Property Flippers maybe property developers that have completed develoments on a revenue account. However the size and scale of the works maybe such that the property is not considered new. In these situations the sales is not a taxable supply.

Tax Treatment

- Enterpise, oridinary business income

- ABN & GST entitlement.

- if not substantially new, no GST, ABN yes.

- Subdived lots, sold separately, subject to GST, margin scheme may benefit

Mere Realisation Example

294. A number of years ago Elsie and Karin purchased some acreage on which to keep their horses, which they rode on weekends. Karin now accepts a job overseas and they decide to sell the land.

295. They put the land on the market with little success. The local real estate agent then advises that it would be easier to sell the land if it was subdivided into smaller lots. They arrange for a development application to be lodged with the local council and obtain approval to subdivide the land into nine lots. Elsie and Karin arrange for the land to be surveyed. The land has a road running along its boundary and has some existing services such as electricity. Only minimal activity is required to subdivide the land.

296. Elsie and Karin are not entitled to an ABN. The sale is not considered to be an enterprise and is the mere realisation of a capital asset.

Accidential Property Example

284. Prakash and Indira have lived in the same house on a large block of land for a number of years. They decide that they would like to move from the area and develop a plan to maximise the sale proceeds from their land.

285. They consider their best course of action is to demolish their house, subdivide their land into two blocks and to build a new house on each block.

286. Prakash and Indira lodge the necessary development application with the local council and receive approval for their plan. They arrange for:

•their house to be demolished;

•the land to be subdivided;

•a builder to be engaged;

•two houses to be built;

•water meters, telephone and electricity to be supplied to the new houses; and

•a real estate agent to market and sell the houses.

287. Prakash and Indira carry out their plan and make a profit. They are entitled to an ABN in respect of the subdivision on the basis that their activities go beyond the minimal activities needed to sell the subdivided land. The activities are an enterprise as a number of activities have been undertaken which involved the demolition of their house, subdivision of the land and the building of new houses.

Enterprise Property Developers – The business of developing Property

Enterprise Property Developers do not have subjective intentions as to the property development been considered a mere realisation, accidential developer or flipper.

The intention is to develop property as a business!

Factors to Consider

- Size and scale of the business

- Property to be considered trading stock

- Many potential investors or stakeholders

- Income and expenses on revenue account.

Tax Treatment

- Entitled to ABN & GST Registration

- Income is ordinary income

- Use of Complex Tax Structures to separate income and risk.

Example – Isolated Property Developments Enterpise.

Example 28

271. Stefan and Krysia discover that the local council has recently changed its by-laws to allow for smaller lots in the area. They decide to take advantage of the by-law change. They purchase a block of land with the intention to subdivide it into two lots and to sell the lots at a profit. They carry out their plan and sell both lots of land at a profit.

272. Stefan and Krysia are entitled to an ABN in respect of the subdivision on the basis that their activities are an enterprise being an adventure or concern in the nature of trade. Their activities are planned and carried out in a businesslike manner.

Example – Isolated Property Development for Private Benefit – Enterprise

Example 29

273. Tobias finds an ocean front block of land for sale in a popular beachside town. He devises a plan to enable him to afford to live there. He decides to purchase the land and to build a duplex. He plans to sell one of the units and retain and live in the other. The object of his plan is to enable him to obtain private residential premises in an area that would otherwise be unaffordable for him.

274. Tobias carries out his plan. He purchases the land, and lodges the necessary development application with the local council. The development application is approved by the council, Tobias engages a builder and has the duplex built. He sells one unit, and lives in the other.

275. Tobias is entitled to an ABN. His intentions and activities have the appearance of a business deal. They are an enterprise.

276. Further, there is a reasonable expectation of profit or gain (see paragraphs 378 to 405 of this Ruling) as his plan has enabled him to be able to keep and live in one of the units.

terpristYour content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Please do your tax due diligence before entering into any proposed development. We can review your strategy and advise on

Please do your tax due diligence before entering into any proposed development. We can review your strategy and advise on

- the likely tax treatments and after-tax profits.

- GST, Margin Scheme, Stamp Duty, Land Tax

- Tax Structures of holding and developing to minimise taxes and risk

- To avoid any tug-a-war with the ATO.