What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

Property Investors

Successful Property Investors use the following key elements within a BUY & HOLD Strategy to build wealth to fund a lifestyle they desire.

On this page we explore these key elements:

Leverage (Debt) to Buy Properties.

Knowledge Skills Property Team

Beware Property Sharks = negative equity

Wealth to Fund $100,000 p.a Income

Related Insights

Tiny homes have excellent rental yields, income streaming and tax minimisation strategies. How do they compare to a Granny Flat?

What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

Easier for Victoricans to build Granny Flats from December 2023.

Secondary Dwelling From December 2023 the Victorian Government has passed planning changes to make it easier to build Granny Flats - or "small secondary dwellings", on existing homes. The Victorian Premier Jacinta Allan revealed that planning permits will no longer be...

Property Investors to ensure income and expenses are correct.

The ATO is particularly targeting property investors that are not using the help of a specialist property tax accountant like Umbrella Property Accountant, due to the high error rate being discovered from ATO Audits. The ATO Audits into self-preparers have uncovered...

Buy and Hold Strategy

Your intention as a Property Investor is to Buy & Hold a number of properties to build enough equity to contribute to funding your lifestyle income. It’s not a question of how many properties, but rather how much net equity with a net return on investment (ROI) you need to work towards!

Your intention as a Property Investor is to Buy & Hold a number of properties to build enough equity to contribute to funding your lifestyle income. It’s not a question of how many properties, but rather how much net equity with a net return on investment (ROI) you need to work towards!

Questions you need to answer?

- What is the required Wealth / Net Equity! – from your property portfolio ( Current values less debt)

- Net ROI – after holding costs – (ie) interest, rates, insurance, maintenance, etc

- To provide your Lifestyle Income

Each Property Purchased will need:-

- Time in the market – however, try to avoid buying at peaks

- To be cash flow positive, (rent covers all interest and holding costs) – Rental Income around 7% on investment.

- To have strong capital growth (7%+ over 10 years)

- Use leverage -Initial use of high levels of debt to buy properties (up to 90% LVR)

- To purchase properties below market values, factoring in any major market Fluctuations, to recreate instant equity.

Leverage to buy properties

Leverage is the use of various types of debt to buy properties you couldn’t buy otherwise with your available equity to create a multiplying effect on your deposit to build net worth.

Leverage is the use of various types of debt to buy properties you couldn’t buy otherwise with your available equity to create a multiplying effect on your deposit to build net worth.

Higher leverage means using higher debt which is commonly described as having a higher LVR ( loan to value ratio).

Multiplying the effect on your Equity

As your investment properties increase in value, the leverage or debt will create a multiplying effect on your underlying equity, see the following

- 10% deposit creates a 10X increase in equity – LVR 90%

- 20% deposit creates a 5X increase in equity – LVR 80%

Please note – less deposit will require you to buy properties that have higher rental income to avoid being cashflow negative.

Example of the power of debt to multiply

John and Mary buy an investment property for $500,000, with a 20% deposit, raised by using the existing equity from other properties, which over time has achieved a 7% annualised capital growth. What is the multiply effect on their equity?

After 1 year

- Capital Growth 7%, Multiplier 5X

- Property increased from $500,000 to $535,000 (7%)

- Deposit $100,000 (20%)

- $35,000 / $100,000 ( your deposit / investment)

- 35% (7% capital growth x 5 multipliers)

- less your interest costs on the $100,000 at say 7%

- Net (ROI) of 28%

Over Time:- Over time your priority will shift from high leverage around 80-90% LVR to a much lower LVR.

De-Leveraging (lowering LVR) debt on your property portfolio can be achieved by a combination of capital growth, positive cash flow to reduce debt, and possible selling down of some properties.

Over a ten-year period, purchasing the right properties (with the key elements) build wealth/equity that will reduce your LVR, and allow for your rental cash flow to fund your lifestyle.

Pay our tax, but don’t tip!

Failing to plan is literally planning to pay – More Tax!

Being tax-smart will ensure you pay less –

- state-based land tax and stamp duty using various ownership structures.

- keep more rental income by maximising all tax deductions possible

- Income & Capital Gains planning to stream to low tax recipients

- Minimise the Capital Gains Tax on disposals or changes

- GST Margin Scheme for developers

- Taxes on property transfers in deceased estates.

Capital Growth – Rule of 72

Residential Properties have achieved organic growth in value over the long term (historical growth has averaged between 6- 8% per annum compounding in most Australian capital cities) plus rental income to service interest and other holding costs.

To fund your lifestyle, these same properties need to be cash flow positive to avoid long-term negative gearing. Over time properties grow in value and rental income, while holding costs like interest fall as a percentage of the overall income (regardless of rising or falling prevailing interest rates at the time.)

If property purchases are missing any of these elements, it may not be possible to build a property portfolio that will greatly contribute to your required net worth to fund your lifestyle income goals.

Rule of 72

- The Rule of 72 is a simplified formula that calculates how long it’ll take for an investment to double in value, based on its rate of return.

Example

If you have an investment property purchased for $500,000 with an annualised capital growth rate of 7%, how many years will it take to double in value?

72/7 = 10.29 years

Knowledge, Skills and Team Members

Specialist Property Tax Accountants – like Umbrella Property Accountants,

- to advise on the correct ownership,

- tax planning to minimise state and federal taxes payable

- assist with property selection that contributes to your lifestyle income goals.

- Working closely with your team to keep the score, unbiased umpire to ensure all team members play by the rules.

Learn to fish! Or your may buy expensive poor quality fish!

Do the study to learn to determine if you are getting unbiased information to make decisions, test the source against your learning and various other sources to gain confidence to work with team members.

All fees should be fully disclosed and agreed to upfront before team members sign on.

Research and negotiation skills and the potential help of a Buyers Agent

Good Property Manager – select and manage tenants

Good Mortgage Broker – unlock equity as future deposits

Good Conveyancer– deal with any complications for buying/selling

Experienced Real Estate Agent that can sell for the best price.

A Financial Planner that can advise on the property within an SMSF to provide a State of Advice (SOA).

Property Sharks – Spruikers = negative equity

Property investment promoters, or spruikers, invite people to their ‘wealth creation’ seminars or online webinars, often for free, with the promise of investment tips or opportunities. They typically promote a property investment system or market a specific property development

Last Bastion of unregulated wealth advice

Property spruikers provide wealth advice investing in property that is not regulated in Australia.

To be an Accountant, Lawyer, Mortgage Broker, Real Estate Agent or Financial Planner you are regulated by professional standards and education. Hard to believe but anyone can run a seminar/webinar to promote building wealth by investing in property without any qualifications or regulations in Australia, it’s true!

Why be a Property Spruiker?

The reason they are doing that is that there’s an extraordinarily high income on offer for any salesperson who can actually get a muns & dads to invest.

Extraordinarily High Property Sales Commission Paid

Secret or undisclosed commissions paid by developers typically range from $30,000 to $100,000. Generally the higher the commission the harder it is for the developer to sell, which generally implies it’s a bad investor stock. You can guest which properties are being sold first (ones with the highest commission paid by developers)!

Signs your at a property spruikers seminar or online webinar!

- Pumping music, hype, excitement, encouraging to buy on emotions – Fear of Missing Out (FOMO)

- Talk about their wealth, not so much about their client’s wealth.

- Limited history, they come out of the woodwork, during property booms, and then disappear.

https://consumer.gov.au/consumers-and-acl/tips/property-spruikers-and-investment-seminars

Wealth to Fund Your Lifestyle Income of $100,000 p.a.

So, what is a wealth target you could aim for to generate a potential lifestyle income of around say $100,000 p.a?

Assuming you could achieve a net 3% return, that is –

- a 3% return after mortgage interest rates and holding costs

- mortgage interest rates of around 5%

- Holding cost of around 2% (rates, water, insurance, agent management, land taxes, repairs & maintenance, etc)

- Excluding your principal place of residence (PPOR)

- What wealth figure would generate $100,000 pa?

Around $3.3m un-geared or net equity property

portfolio returning around 5% would work.

- Running Costs around 2% $66,667

- No Interest holding cost on the net equity position, all other geared / debt on properties is achieving around 7% returns with interest rates at around 5% and other holding costs around 2%.

Note:- Properties with optimal Depreciation Claims create high non-cash expenses, which can equate to tax savings of around 1% towards reducing the required gross returns.

It’s not so much a question of how many properties you need but rather which properties will get you to the net equity position you need to achieve for example a $100,000 p.a lifestyle income.

An Example

You may need to purchase up to 6 + properties for around $500K each, or 12+ around $250,000 with good capital (around 7% annualised) and rental income of around 7% annualised over around 10 years to achieve a net equity position of around $3.3 million.

Other Investments can contribute

- like shares,

- downsizing your home (PPOR),

- superannuation,

- sale of a business

- may all help bridge the gap to achieve your wealth / net worth goals to fund your lifestyle income.

- The property portfolio will be a major contributor to achieving your net worth goals to fund your lifestyle income, however, it may be a team effort with other assets accumulated over time.

Tax Structure for Property Investors

Will also need to consider what tax structure and state location as part of the strategy to invest.

Individual Names – co-ownership ( Joint or tenants in common)

Either as joint tenants or tenants in common

Either as joint tenants or tenants in common

Joint tenants are typically used for couples, whereby the deceased share will transfer to the survivor.

Tenants in common suits un-related individuals to purchase together, and for tax planning and estate planning.

Pros

- Simple, easy to understand and get finance

- After-Tax Deductions provide tax refunds

- Lower State Taxes like Stamp Duty and Land Tax compared to other structure

- easier to start investing in property

Cons

- No Asset Protection for those in high-risk occupations

- No Income Splitting to reduce tax, on cashflow positive properties or capital gains on the sale

- Limited estate planning.

- Must have a written co-owner agreement for dispute resolution.

- (ie) one co-owner wants to sell the property and the other does not.

Property Trust – Fixed, Discretionary or Hybrid

Pros

- Asset Protection

- Estate Planning Opportunities, ownership can stay in the family independent of the death of the original investors

- Income Splitting for Income and capital gains

- State Land Tax Planning Opportunites, if you want to exceed the Land Tax Threshold in each State

- Can use equity to fund future purchases of property

- Good structure for Simple Family Property Developers

Cons

- higher setup cost and ongoing accounting and admin fees

- Harder to get finance for the inexperience investors

Will required to setup multi Trust for each state for state land tax planning - Negative Gearing is trapped inside the trust for the future

- Can be difficult to have unrelated investors

Property Company – multiple shareholders types

Pros

- Similar to Property Trust

- 30% tax rate for passive investors (1-10 properties, and 25% for property businesses (10+ self-managed) or developers

- Can be used as an unregulated superannuation fund for retirement income.

- Long-term, retained profits can be paid out fully franked in retirement, and franking credits can be refundable

- Profits will pay less tax, to allow for higher re-investment to grow the property portfolio

- Div 40 Capital Allowance (depreciation) on second-hand plant and equipment, not available to Trust, SMSF, or individuals

- Good structure for Property Developers

Cons

- As with Property Trust

- No Capital Gain Tax 50% discount on the sale of properties

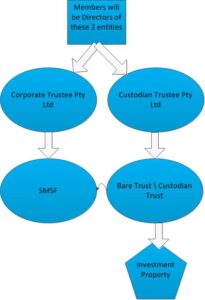

Self-Managed Super Funds (SMSF)

Pros

- Asset Protection

- Estate Planning – 6 family members

- Lower taxes in the accumulation phase( 15% on income, 10% of CGT), and none in the pension phase

Cons

- ASIC recommends a fund balance over $200,000 to justify higher admin and accounting fees

- Cannot borrow against the equity to purchase other properties

- Separate Bare Trust for each geared property.

- Higher Interest rates and low LVR typically

- Very High Complaint around SIS Act

Property Investment Asset Classes for Investors

Residential Property

The most understood property class to invest in by most households.

LVR up to 95%, but not recommended above 80%.

Commercial Residential

Commercial residential properties are taxable supplies, GST treatment will need to be considered.

- Bed & Breakfast

- Multi – Airbnb

- Caravan Parks & Camping Grounds

Industrial & Commerical Properties

Property Values are based generally on a 5-7% ROI, with outgoing paid by tenants.

LVR is around 70-80%

Loan rates can be higher, and loan terms shorter.

Lease terms are longer, and the vacancy period between tenants is longer.

Can be subject to GST

NDIS & Affordable Housing

Similar to residential, but treat more like a commercial for lending with much higher rental income compared to residential.

High entry investment required, lower LVR, commercial lending, suitable to sophisticated investors only.

GST Free Income