What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

Brisbane House Prices one of the most affordable across Australia

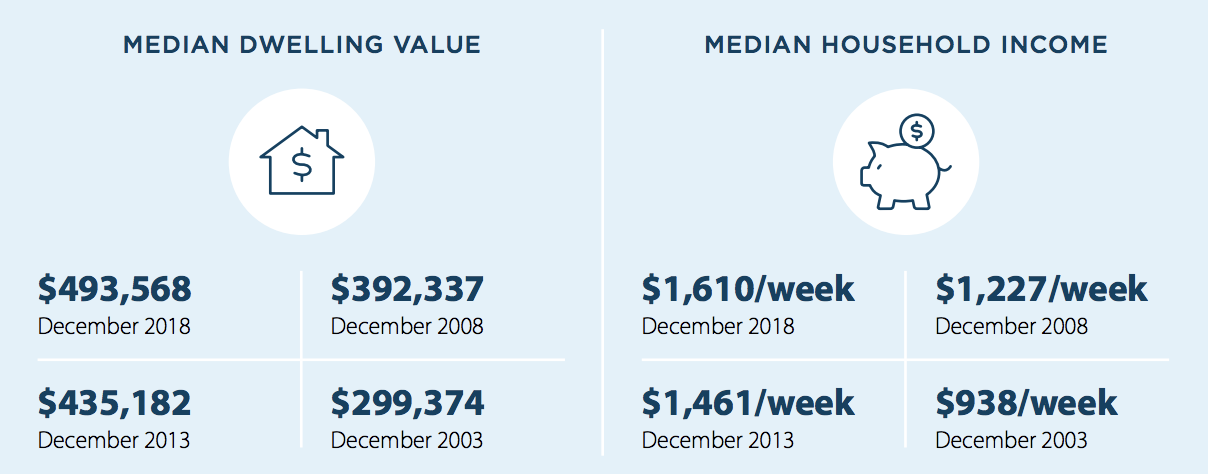

Brisbane’s housing affordability has improved over the most recent quarter due to increasing household incomes rising faster than dwelling values.

Over the past decade, affordability has improved because household incomes have increased by 31.2 per cent while median values have increased by a lower 25.8 per cent,” the report notes. The overall household increase in incomes has been more than house prices in real terms. This is great news for first home buyers.

It also found Darwin is now the most affordable capital city for buyers, and Hobart is the nation’s least affordable capital city for renters.

Source:- ANZ-Corelogic & The Urban Developer

Brisbane’s House Prices has had one of the most modest increases over the last decade at 25.8%, compared to Sydney at 88.3%, Melbourne at 67.9%. Comparing that household incomes increases of Brisbane at 31.2%, Sydney at 41.2% and Melbourne at 37.5%, the overall affordability of house’s Brisbane has increased the most of the three cities of Australia’s Eastern States.

There is some concerns that investors from Southern States will look to the SEQ Market chasing value and higher rental yield than what is typically offered down south.

According to CoreLogic, Melbourne’s gross rental yields are now only 2.7%, the lowest in the country, with Sydney at 2.9%.

Brisbane and SEQ rental yield in the 5% range are not hard to find

Property Market outlook post Election

First Home Deposit Scheme which starts on January 1 2020, eligible first home buyers earning up to $125,000 or couples earning up to $200,000 will be able to lend up to 95 % of the purchase price of a property, provided they have already saved an initial 5% deposit. Which at a time of increased affordability in the property market will ensure First Home Buyers can get a foot on the Property Ladder.

APRA, which dictates lending standards is reducing the current 7% stress test buffer used by banks to assess serviceability for loans.

Negative Gearing for Property Investors will remain, allowing losses to be offset against other incomes.

Tax Advisor fees in excess of $3K will continue to be tax deductible.

50% CGT discount on investment properties held over 12 months remains unchanged.

If you would like any property related advice, please feel free to contact us.