What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

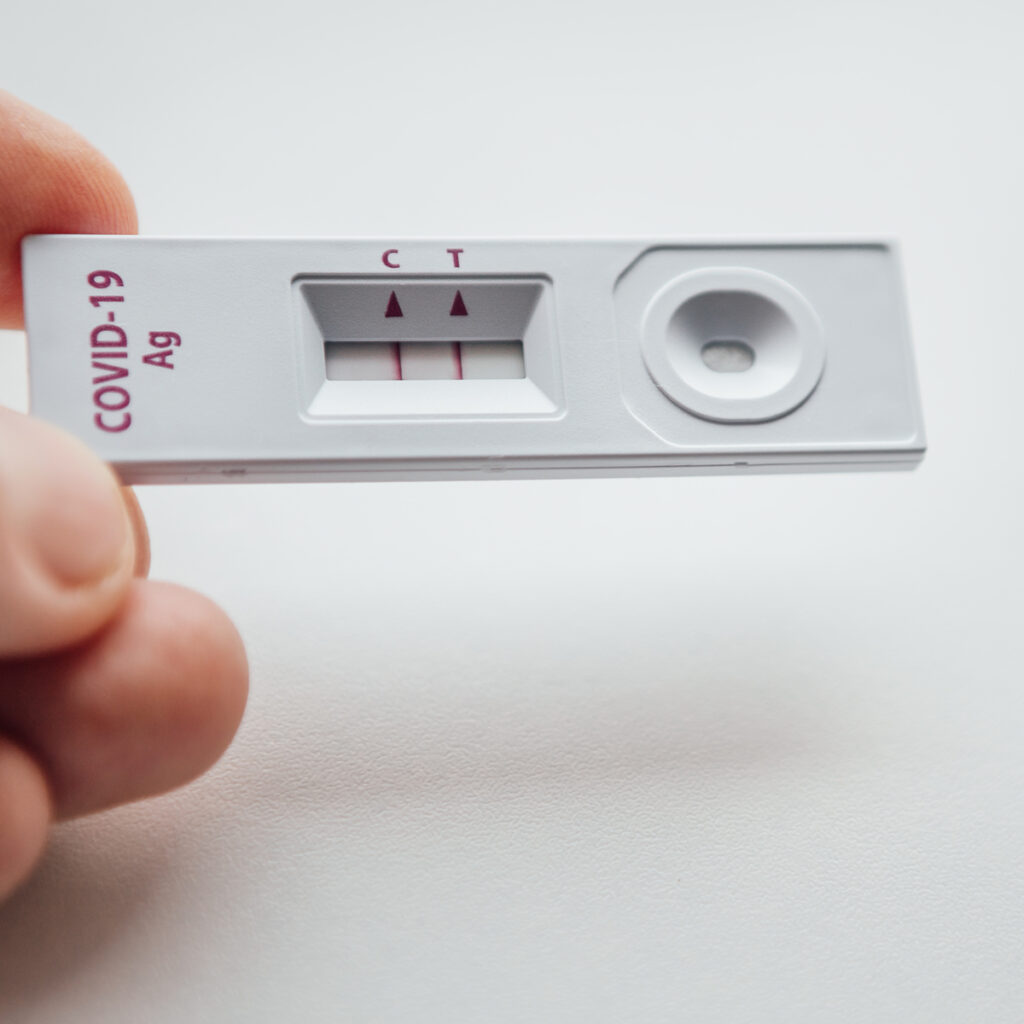

Rapid Antigen Test (RAT) Kits are tax-deductible?

Yes can claim the tax deduction for money spent on a RAT kit in the following cases:

1. You are required to take a test before undertaking work (e.g., as a mandatory requirement under an employer’s COVID mandate),

or2. You are required to travel for work interstate and the RAT is required under a State direction or health order to enter the State or return to your home state.

But of course, if you have purchased a RAT kit for private purposes (personal travel, convenience, absence of PCR testing) or you’ve been reimbursed by your employer it will not be tax-deductible.

Like to chat further, please contact us